How Peak Demand Shapes Building Costs, Emissions, and Operations

- Ava Montini

- Jul 15, 2025

- 5 min read

By mid-July, the weather forecast stops being small talk. It becomes operational.

With heat domes intensifying across North America and grid operators issuing near-daily alerts, facility and portfolio managers are paying closer attention and for good reason.

Ontario’s IESO issued more peak warnings before August than in the entire 2022 season. In 2024, Texas broke its own energy demand record 10 times. According to the U.S. Energy Information Administration, commercial buildings in the U.S. now consume around 35% of the nation’s electricity, making this sector a key player in shaping grid performance during high-load periods.

Energy usage is showing up beyond the utility bill; in Scope 2 emissions disclosures, tenant expectations, and stakeholder audits. With grid volatility rising and energy performance now directly tied to financial exposure and emissions visibility, organizations are starting to reassess how energy decisions are made, tracked, and reported.

Energy, increasingly, is functioning as a real-time indicator of how integrated and responsive a business truly is.

Energy Has Left the Boiler Room

By now, it is well known in commercial real estate that energy data now reaches beyond utility bills. It now plays a role in broader business decisions, even if that shift has happened gradually.

According to CBRE’s 2024 Global Investor Intentions Survey, 59% of respondents now factor sustainability-linked performance into their investment evaluations. Energy efficiency specifically was cited as a way to protect long-term value, something increasingly relevant as operating costs and emissions reporting become more closely tied.

This kind of performance data doesn’t just stay within the engineering team. It’s showing up in investor due diligence, influencing lease terms, and being used to support eligibility for green financing or incentive programs.

What also matters is how efficiency is tracked, shared, and applied to meet business goals. Consistent performance during peak periods, clear Scope 2 reporting, and reliable internal coordination are becoming expected, especially in markets under regulatory or stakeholder pressure.

These are no longer emerging trends. They’re baseline expectations for any organization managing significant energy loads.

A Few Hours Can Shape Your Annual Energy Spend

Many commercial buildings are billed not just for how much energy they use, but when they use it.

In most North American markets, utilities and grid operators apply what's called "peak demand pricing," a system that looks at a facility’s electricity use during the most critical periods on the grid, typically when demand is at its highest and supply is tightest. These peak periods often occur during extreme heat events or late afternoons in the summer.

Utilities use these moments to assess each building’s contribution to overall grid stress. That data is then used to determine a portion of the facility’s charges for the following year, often under separate line items like demand charges, capacity tags, or grid contribution fees.

In Ontario, for instance, a commercial building’s Global Adjustment (GA) charges are based on its electricity load during the five highest one-hour demand periods between May and October. These hours aren’t announced in advance, but are predicted with some accuracy by monitoring weather and grid forecasts. The IESO uses this data to assign an "ICAP tag," which influences your facility’s GA cost over the next billing cycle.

In the U.S., several regional transmission organizations (RTOs) such as PJM, ISO-NE, ERCOT, and NYISO use similar methods. ERCOT’s 4CP (Four Coincident Peaks), for example, calculates charges based on your facility’s usage during four peak hours—each occurring on the highest-demand day in June, July, August, and September.

These billing models are especially impactful in sectors with high energy intensity or round-the-clock operations: healthcare, food storage, manufacturing, data centers. In these cases, those few hours can account for 30% to 70% of the annual electricity bill, depending on rate structure and local regulations.

Unlike fixed charges, these costs can be actively managed. Facilities that have visibility into upcoming peak periods and a plan to temporarily reduce load—even by 5% to 10%—can significantly cut future costs and improve their carbon reporting by reducing emissions during grid-critical periods.

Grid Strain Is Becoming More Common

During 2024, regional electricity demand hit new highs across North America, and the pace is changing how energy is managed today.

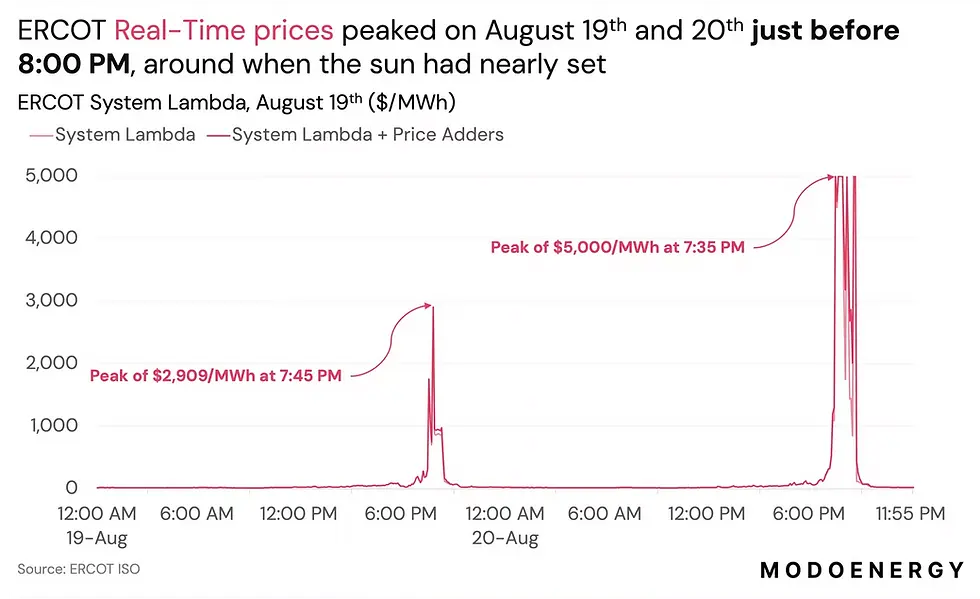

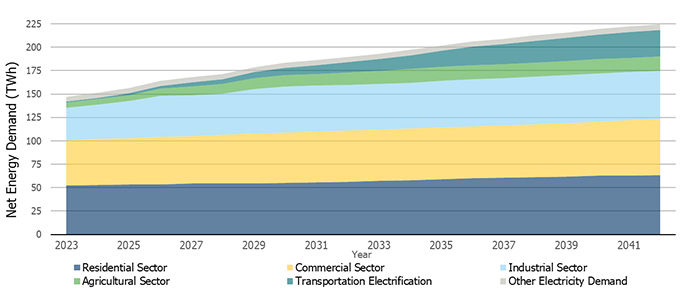

In Texas, ERCOT reached a record 85,931 MW of demand on August 20, 2024, surpassing its previous all-time high set the year before. This surge wasn’t a one-off. In May 2025, ERCOT warned that demand might exceed 84,000 MW, potentially challenging the previous May record of 77,000 MW. These numbers reflect rising load from data centers, EV charging, and increased AC usage, raising the stakes for flexibility in facility operations.

In Ontario, 2024 brought a similar trend. Warmer-than-usual summer temperatures led to 277 peak hours above 20,500 MW demand. Double the 138 hours seen in 2023. Meanwhile, refurbishments at nuclear plants and reduced imports forced the grid to rely more on gas generation. These factors have introduced more volatility into rate structures and heightened the risk for assets that lack demand-side flexibility.

July Offers a Useful Midpoint for Evaluation

By this stage in the summer, most large energy users have had at least one or two opportunities to respond to a peak event. This creates a natural checkpoint.

Was your team prepared?

Did the systems respond as expected?

Were load reduction strategies discussed across departments, or handled in isolation?

Demand charges alone can represent 30–70% of a commercial customer’s total electricity costs, and adopting time-based rate strategies has enabled many to reduce peak usage by around 16% on average, sometimes reaching up to 40%

Performance Is Increasingly Measured in Real Time

As ESG reporting becomes more sophisticated, energy data is being tracked and evaluated at a finer level of detail. The Greenhouse Gas Protocol now encourages organizations to report Scope 2 emissions using time-based methods that reflect when electricity is consumed and how carbon-intensive the grid is at that hour.

Temporary spikes during peak demand periods can now influence not just emissions totals, but also eligibility for incentive programs and performance-based certifications. LEED and ENERGY STAR, for example, have begun placing more emphasis on interval data and how buildings perform under real operating conditions.

For property managers and sustainability leads, being able to show avoided demand during grid-stressed hours adds credibility to reporting.

As the second half of summer unfolds, the patterns emerging now, how buildings respond, how teams coordinate, and how data is tracked, will quietly shape the months ahead. Even without sweeping changes, the season offers a chance to observe, adjust, and carry forward what proves useful.

Energy may be a technical input, but increasingly, it reflects how an organization works under pressure and where it’s headed next.